It’s mid January, which means that many small business owners across the country are scrambling to fill out Form 1099. It used to be that “1099” meant, in most people’s minds, the 1099-MISC. This form was, for nearly 35 years, the dominant form used to report contractor/service income. However in 2020, 1099-NEC (non employee compensation), has made a comeback. Which in true IRS fashion, has created some confusion on which form to fill out. However in my previous post, I outlined the difference between 1099-MISC and 1099-NEC, and what goes on each form. But there is a myriad of different 1099 forms that are used for everything from debt cancelation, to recording capital gains.

So How Many Variations of Form 1099 Are There?

Well as of right now there are 20 different form with 1099 in the title, which is a lot. Like I said above the Internal Revenue Service likes to makes everything more confusing than it needs to be. However, if you’re ever confused about the gist of a 1099 form, just remember that it is related to income in some way. More specifically, it’s related to the recognition of income. The point of these forms is that two parties inform the IRS about income so that they have something to compare the return to. Normally 1099’s are issued at the latest by March. This is done to ensure that people can get their taxes done on time.

So what kinds of income does Form 1099 recognize?

Because the IRS can’t be everywhere at once, we have to tell them when transactions happen. We do this by issuing 1099s, which as I stated above, there are 20 variations of them, and these variations consist of the following:

Common Form 1099 Variations

- 1099-B – Proceeds from broker and barter transactions

- Outside of 1099-DIV and 1099-INT this is the 3rd most common 1099 on this list. This is received mainly from a brokerage house and has all of the transactions made through that brokerage house. An example would be getting a 1099-B from TD Ameritrade with all of you trades on it. Interestingly, enough there is no threshold and these have to be issued for any amount of proceeds.

- 1099-C – Cancellation of Debt.

- This was a much more common form during the Great Recession, when folks were having their mortgages forgiven in exchange for some amount of payment. This debt forgiveness goes on a 1099-C and should be filed with the IRS and also sent to the debtor.

- 1099-DIV – Dividends and Distributions

- This might be tied with 1099-INT for being the most common 1099 issued. Partially because of the $10 threshold, meaning all dividend income over $10, requires this form to be issued.

- 1099-G – Certain Government Payments

- This is mostly for gambling winnings.

- 1099-INT – Interest

- This is the most common, if not one of the most common 1099s, required for any interest more than $10.

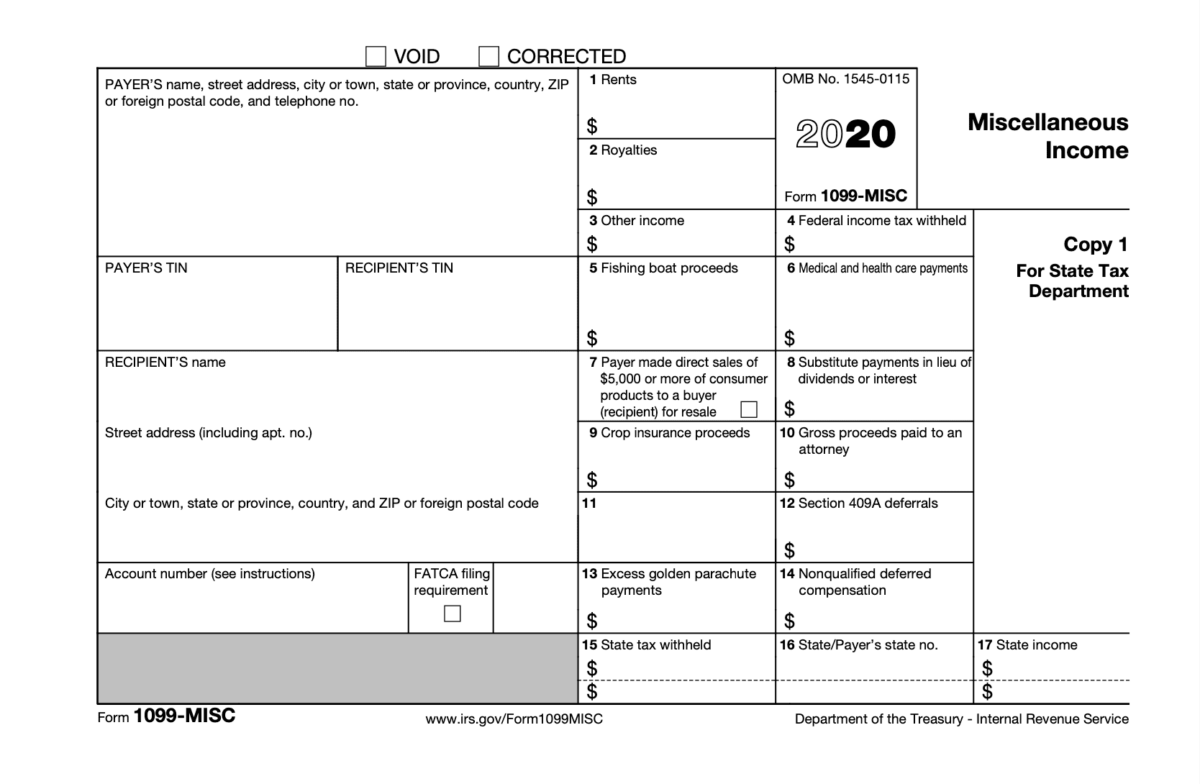

- 1099-MISC – Miscellaneous Income-

- Until 2020, this included non employee compensation in box 7. However this year 1099-NEC will be handling non employee compensation. Now this form is mainly used for rent and royalties.

- 1099-NEC –Non employee compensation

- Any none employee compensation (like paying a contractor), over $600 in a given year, will require this form.

- 1099-R – Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Mainly used for retirement plans and pensions.

- SSA-1099 – Social Security Benefit Statement

- Kind of self explanatory but this is another extremely common 1099. Especially for those who are over 65.

- 1099-S – Proceeds From Real Estate Transactions

Less common Form 1099 variations

- 1099-K – Merchant Card and Third Party Network Payments

- 1099-A – Acquisition or Abandonment of Secured Property

- 1099-CAP – Changes in Corporate Control and Capital Structure

- With a threshold of $100 million this is an extremely uncommon 1099 to file.

- 1099-LTC – Long-Term Care and Accelerated Death Benefits

- 1099-H – Health Coverage Tax Credit (HCTC) Advance Payments

- 1099-OID – Original Issue Discount

- 1099-PATR – Taxable Distributions Received From Cooperatives

- This is a common 1099 for farm cooperative income.

- 1099-Q – Payments From Qualified Education Programs

- 1099-SA -Distributions From HSA’s and MSA’s

- RRB-1099 – Railroad Retirement Board Statement

Conclusion

In conclusion, there are a myriad of different 1099s that are issued to taxpayers every year. This is because the IRS has to keep track of a lot different types of revenues. At first this can seem complicated. However a registered CPA can usually handle most 1099 issues. Almost all 1099’s are due by the end of March, at the latest. This means that it is important to start planning your 1099 filing strategy early, preferably before the beginning of the year.