Capital gains are great but the taxes suck. We all know this, and we all want to pay less taxes. How can we do this? Well unfortunately there aren’t a lot of ways. However, one way to potentially minimize taxes is to hold. More specifically, holding a capital asset for longer than a year which would make it long term instead of short term.

How Short Term Capital Gains Are Taxed

Short term capital gains are defined as the sale of a capital asset within a period of 12 months after purchase. Anything longer than 12 months is long term. These short-term sales are taxed the same as ordinary income. This makes it simple to account for, but again the rate is higher. For example, in 2021 the maximum ordinary tax bracket was 37%.

How Long Term Capital Gains are Taxed

Long term capital gains are defined as the sale of capital assets after a period of 12 months from the purchase date. These obviously include things like stocks, bonds and even real estate (with the exception of your primary residence). The taxation on these sales is quite a bit lower than what you would get taxed normally. Think of it as the government rewarding people that are actually trying to make investments, instead of gambling.

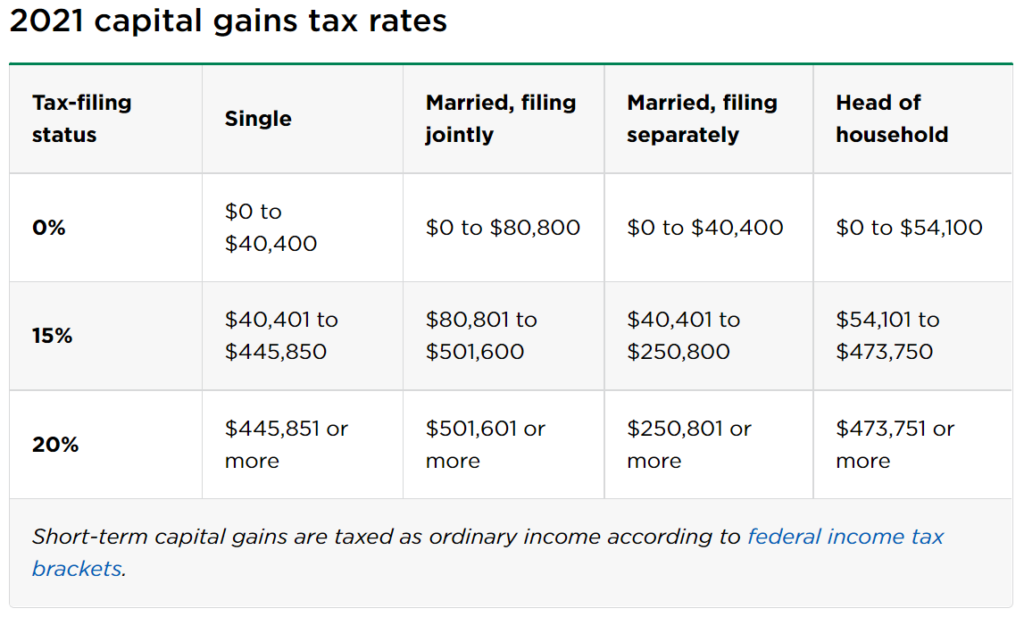

As you can see in the tables above, the max tax rate for long term holdings is only 20%, which is significantly less than the maximum ordinary income tax rate of 37% in 2021. This means that you could perhaps save money, by holding onto your investments only a few months more. Now, perhaps you don’t have enough cash flow to hold onto all of your investments for 10 years. However, holding onto capital investments a couple of extra months could have huge impacts on your tax situation. As always, it is important to talk to a licensed CPA in order to come up with a game plan for your unique tax situation and create tax outcomes that will hopefully save you a lot of money, come tax time.